The Swiss banking group Julius Baer has released an analysis of the oil market, projecting a supply surplus until 2025. This forecast comes despite ongoing geopolitical tensions and fluctuating market sentiments. The financial institution, known for its commodity market assessments, has taken a neutral stance on oil prices. Julius Baer’s analysis suggests that supply will […]

Related Posts

Brazil records second-highest tourism spending, surpassed only in 2014

According to the Central Bank of Brazil, international tourists spent over R$18 (US$3.6) billion in Brazil in the first half of the year, making it the second-highest expenditure recorded, only surpassed by 2014, the year Brazil hosted the World Cup. In the first six months, Brazil welcomed over 3.2 million foreign tourists, as per a […]

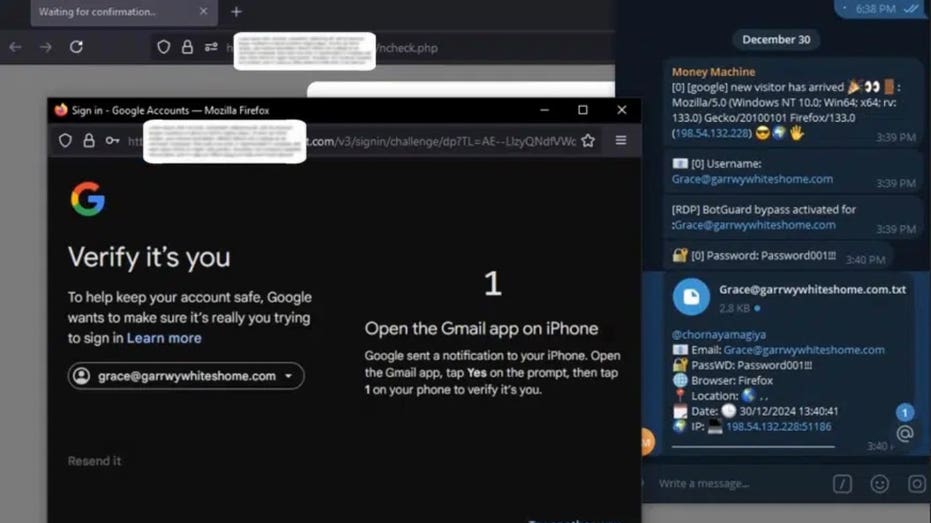

New phishing attack uses real-time interception to bypass 2FA

Phishing attacks are everywhere, and most of us can spot the obvious ones. Even if someone falls for one and hands over their password, two-factor authentication (2FA) usually adds a crucial layer of protection. But a new phishing kit making the rounds can bypass 2FA entirely by using session hijacking and real-time credential interception. Known […]