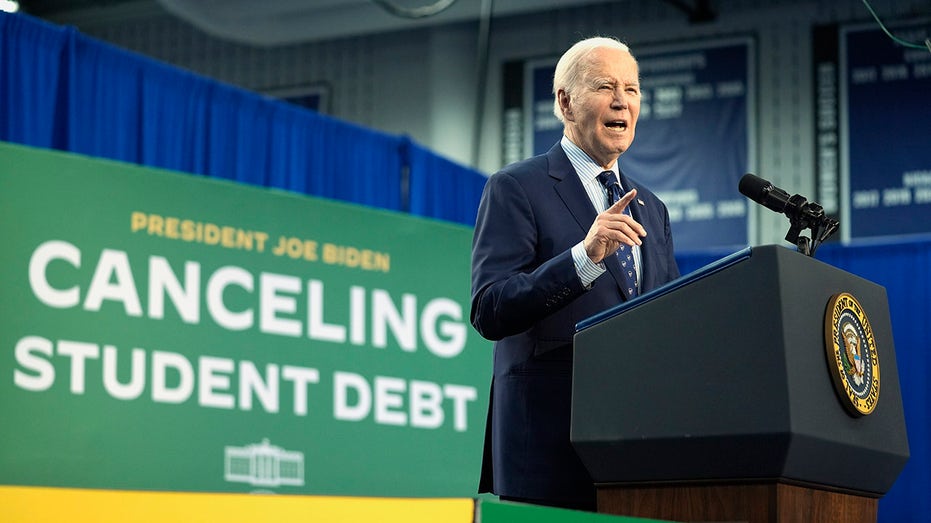

President Biden is making a last-ditch effort to cancel more student debt before the end of his term, after facing years of setbacks in his attempts to erase billions of dollars in borrowed money.

The Department of Education announced an interim final rule this month to extend the deadline for student loan borrowers to enroll in long-term pay-over-time programs.

The provision would amend the Income Contingent Repayment (ICR) to extend the deadline for borrowers to enroll in ICR or Pay-As-You-Earn (PAYE), a program which cancels all student debt for borrowers after 20 years of on-time payments. The enrollment deadline would be extended by three years, from July 2024 to July 2027.

The regulations, however, are slated to go into effect in July 2026, meaning the incoming Trump administration could intercept any handout initiatives going into effect after his term.

FORMER TRUMP EDUCATION SECRETARY LAYS OUT ‘UNFINISHED BUSINESS’ FOR NEW ADMIN ON SCHOOL REFORMS

The announcement comes just weeks after the Biden administration put forward an additional new rule, that, if finalized, would authorize student debt forgiveness on a one-time basis for people who the department considers to have at least an 80% chance of defaulting on loans based on a “predictive assessment using existing borrower data.”

Also in October, the administration announced plans to remove $4.5 billion in debt for more than 60,000 borrowers who work in public service.

During his 2020 presidential campaign, Biden pledged to forgive student loans for millions of Americans if elected, but the president has faced continuous legal roadblocks in his attempt to eliminate hundreds of billions of dollars in debt.

Biden’s initial plan sought to provide up to $10,000 in debt relief, and up to $20,000 for Pell Grant recipients, for people who make less than $125,000 a year — which was estimated to cost more than $400 billion.

However, in June 2023, the Supreme Court issued a ruling against Biden’s loan cancelation plans which stated that the secretary of education cannot cancel more than $430 billion in student debt.

The president, however, made another attempt to cancel debt for roughly 30 million Americans. Biden’s second proposal sought to cancel up to $20,000 in interest for Americans who owe more than they borrow, as well as cancel all debt for those who have been repaying undergraduate loans for 20 years or more.

President-elect Trump has not said specifically how he will approach the Biden administration’s student loan forgiveness plans, but has said he plans to rework the entire education system during his term.

The former education department secretary under Trump recently told Fox that Biden’s attempt at student loan handouts needs to be reevaluated by the incoming administration.

“There is every argument for if the taxpayers are going to be funding student lending, there better be ways to oversee it and actually do it effectively and efficiently,” former Secretary of Education Betsy DeVos told Fox News Digital in a recent interview. “And it has not been happening. It is a huge mess, and it needs to be rethought and re-examined, and frankly, the private sector, private sector lending needs to come back into it and be an option.”

Fox News’ Alec Schemmel, Chris Pandolfo, and Jamie Joseph contributed to this report.